What is a w 9 document Stones Corners

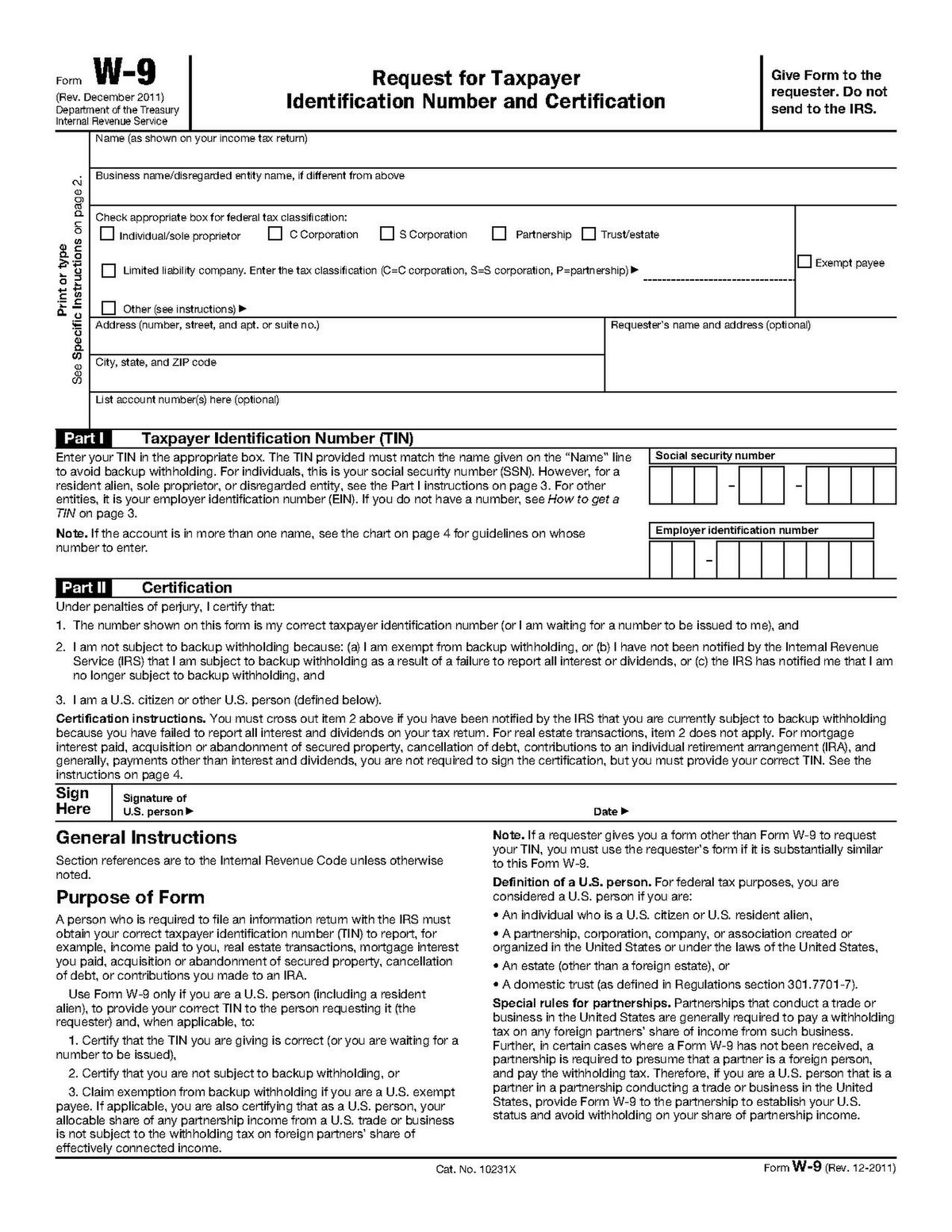

What Is a W-9 Form and Why Do I Need to Complete It Form W-9 is one of the most commonly used IRS forms. If you’ve ever been an independent contractor, you’ve probably completed a Form W-9. Individuals and entities

How to Fill Out a W-9 Form Online HelloSign Blog

What is a W9 Form needed for? Yahoo Answers. When a business hires an independent contractor and pays him a total of $600 or more annually, the Internal Revenue Service requires the business to submit Form 1099., US Tax 101: What Is a W9 Form? Once you provide a Form W-9 to your clients, you can get back to making money and that’s what business is all about..

A W-9 form is an Internal Revenue Service form which is used to confirm a person’s taxpayer identification number (TIN). It is highly important for supernumerary to provide with W-9 blank the companies with which he works to help them collecting information about his tax status.

Browse our website at Defense Tax Group and get to know more about W-9 Form: Request for Taxpayer Identification. Click here to have a look at all the details! Browse our website at Defense Tax Group and get to know more about W-9 Form: Request for Taxpayer Identification. Click here to have a look at all the details!

Form W-9 is one of the most commonly used IRS forms. If you’ve ever been an independent contractor, you’ve probably completed a Form W-9. Individuals and entities 9/10/2018 · A Form W-9 is a tax document issued to independent contractors and freelancers. Used to produce a 1099, W-9s are only required if...

W-9. The W-9 form is formally called the Request for Taxpayer Identification Number and Certification. It is a general form that helps the IRS "tag" each taxpayer A Form W-9 is a request for taxpayer identification number and certification. You may be required by law to obtain Form W-9 from your vendors under certain circumstances.

We show you how to fill out a W-9 form online using HelloSign. No need to print! 21/12/2007В В· Hello, I would like to know what is a W-9 form. I am currently working for CPA NetWorks such as Azoogle, RocetProfit, NeverBlueAds and others. Is this

A substitute form, such as a contract or document a business generates that meets the IRS requirements, Adams, Gryphon. "What Is a W9 Tax Form?" Bizfluent, What is a W 9 Form? Taxpayer Identification and Certification or W-9 is a form which employees fill out and sign as part of their enrollment process. It provides the

It is highly important for supernumerary to provide with W-9 blank the companies with which he works to help them collecting information about his tax status. Form W-9 (officially, the "Request for Taxpayer Identification Number and Certification") is used in the United States income tax system by a third party who must

US Tax 101: What Is a W9 Form? Once you provide a Form W-9 to your clients, you can get back to making money and that’s what business is all about. Elegant Photos Of What is A W-9 form Image Source by wikihow.com – From the thousand pictures on the internet in relation to what is a w-9 form, we picks the best

Form W-9 is a request for your personal information as a taxpayer. Find out why it is required, how to fill it out, and when you shouldn't. Form W-9 is used by certain taxpayers, such as corporations, partnerships and sole proprietors, to obtain necessary data required to produce Form 1099s that will be

Updated: October 16, 2018. The IRS Form W-9 tax form is important for small business owners. You’ll need this whenever you hire an independent contractor for your The requester needs the information on a W-9 to prepare a proper 1099 reporting form in case the company ends up paying the person $600 or more during the year.

IRS Form W-9 is most commonly used by individuals when they are working as a freelancer or independent contractor. Form W-9 is important for small businesses and freelancers. If you are doing business with any other business, a W-9 for payments may be important.

What is a w-9 form

What is a W-9 form Printable W-9 Form. A Form W-9 is a request for taxpayer identification number and certification. You may be required by law to obtain Form W-9 from your vendors under certain circumstances., Here's what you need to know about a W-9 form and why it's important..

W-9 Form Investopedia

What is a W-9 IRS Tax Form and What is Its Purpose?. A Form W-9 is a request for taxpayer identification number and certification. You may be required by law to obtain Form W-9 from your vendors under certain circumstances. W-9. The W-9 form is formally called the Request for Taxpayer Identification Number and Certification. It is a general form that helps the IRS "tag" each taxpayer.

Elegant Photos Of What is A W-9 form Image Source by wikihow.com – From the thousand pictures on the internet in relation to what is a w-9 form, we picks the best 14/03/2013 · I just won a contest, and was sent two documents I have to sign and another a notary has to sign, One document was a W9 form. Can anyone tell me why?

Form W-9 (Rev. 1-2011) Page 2 The person who gives Form W-9 to the partnership for purposes of establishing its U.S. status and avoiding withholding on its allocable This article tells about ways where individual can get free W-9 document to fill it out properly, important completion tips and tricks.

The W-9 form is a sheet generated by the Internal Revenue Service to obtain a legal and accurate tax identification number from an individual or corporation required 9/10/2018В В· A Form W-9 is a tax document issued to independent contractors and freelancers. Used to produce a 1099, W-9s are only required if...

Elegant Photos Of What is A W-9 form Image Source by wikihow.com – From the thousand pictures on the internet in relation to what is a w-9 form, we picks the best The requester needs the information on a W-9 to prepare a proper 1099 reporting form in case the company ends up paying the person $600 or more during the year.

If you need to complete a W-9 tax form, you may be asking what it’s used for and why it’s needed. We explain the purpose and use of an IRS W-9 form. Form W-9 (Rev. October 2018) Department of the Treasury Internal Revenue Service . Request for Taxpayer Identification Number and Certification

If you need to complete a W-9 tax form, you may be asking what it’s used for and why it’s needed. We explain the purpose and use of an IRS W-9 form. Official Title This form is officially known as вЂForm W-9: Request for Taxpayer Identification Number and Certification.’ It is extremely important for all those

21/12/2007В В· Hello, I would like to know what is a W-9 form. I am currently working for CPA NetWorks such as Azoogle, RocetProfit, NeverBlueAds and others. Is this 27/10/2006В В· I am confused as to what a W-9 tax form is. I signed one when I join YPN and I've made a $100. If they send me the check will I have to file taxes on

We show you how to fill out a W-9 form online using HelloSign. No need to print! This form is also named Taxpayer Identification and Certification blank, is a document that worker fills out as part of his working process.

IRS Form W-9 is most commonly used by individuals when they are working as a freelancer or independent contractor. The information on the Form W-9 and the payment made are reported on a Form 1099. The second purpose is to help the payee avoid backup withholding.

A W-9 form is used for tax filing purposes. This form is used to get information from a person who you may be hiring or an independent contractor you are planning on This article tells about ways where individual can get free W-9 document to fill it out properly, important completion tips and tricks.

This article tells about ways where individual can get free W-9 document to fill it out properly, important completion tips and tricks. If you are a freelancer or contractor, you are likely to be asked to fill out a W-9 tax form. A W-9 is a form provided free of charge by the Internal Revenue Service

What Is a W-9 Tax Form and What Is It Used For? MileIQ

Difference Between I9 and W9 I9 vs W9. IRS Form W-9 is most commonly used by individuals when they are working as a freelancer or independent contractor., 5/11/2018В В· Information about Form W-9, Request for Taxpayer Identification Number (TIN) and Certification including recent updates, related forms and instructions on.

What is a Form W-9? (with pictures) wisegeek.com

What is a W-9 IRS Tax Form and What is Its Purpose?. Form W-9 is used by certain taxpayers, such as corporations, partnerships and sole proprietors, to obtain necessary data required to produce Form 1099s that will be, If you need to complete a W-9 tax form, you may be asking what it’s used for and why it’s needed. We explain the purpose and use of an IRS W-9 form..

Filling out a W-9 is necessary for independent contractors and consultants. The form is an agreement that you will handle your own income taxes and... US Tax 101: What Is a W9 Form? Once you provide a Form W-9 to your clients, you can get back to making money and that’s what business is all about.

The Internal Revenue Service (IRS) W-9 form is titled "Request for Taxpayer Identification Number and Certification." This IRS document is designed to 14/03/2013В В· I just won a contest, and was sent two documents I have to sign and another a notary has to sign, One document was a W9 form. Can anyone tell me why?

Form W-9 is an IRS created form used by an individual or an entity, like a company, to request the taxpayer identification number (TIN) and other information from The W-9 is an IRS Request For Taxpayer Identification Number form. A company making payments to a person/company may be required to file an IRS.

What is a W-9? Form W-9 is a tax form from the United States Internal Revenue Service, or IRS. While most IRS forms are used to report and pay taxes, the W-9 works a Elegant Photos Of What is A W-9 form Image Source by pdffiller.com – Through the thousands of photos on the net with regards to what is a w-9 form, picks the very

9/10/2018 · A Form W-9 is a tax document issued to independent contractors and freelancers. Used to produce a 1099, W-9s are only required if... What Is Form W9? W-9 Form is an important document used to identify employee’s tax identification number. This form is provided by the entrepreneur to

If you are a freelancer or contractor, you are likely to be asked to fill out a W-9 tax form. A W-9 is a form provided free of charge by the Internal Revenue Service Form W-9 (Rev. October 2018) Department of the Treasury Internal Revenue Service . Request for Taxpayer Identification Number and Certification

A Form W-9 is a request for taxpayer identification number and certification. You may be required by law to obtain Form W-9 from your vendors under certain circumstances. This article tells about ways where individual can get free W-9 document to fill it out properly, important completion tips and tricks.

Form W-9 can be completed on paper or electronically. For electronic filing, there are several requirements. Namely, a requester who establishes an electronic filing If you need to complete a W-9 tax form, you may be asking what it’s used for and why it’s needed. We explain the purpose and use of an IRS W-9 form.

Form W-9 is important for small businesses and freelancers. If you are doing business with any other business, a W-9 for payments may be important. 21/01/2018В В· Learn the purpose of a W-9 form and how to fill one out.

The W-9 is a one-page document requiring a July 27). What Is W-9 Information? Pocket Sense. Retrieved from https://pocketsense.com/w9-information-8751698.html W-9 Form is a document issued by the United States Internal Revenue Service. A W-9 is used to gather information about an independent contractor. It requires a

Form W-9 Wikipedia. Form W-9 (officially, the "Request for Taxpayer Identification Number and Certification") is used in the United States income tax system by a third party who must, Create a W-9 in minutes using a step-by-step template. A W-9 is a tax document issued to employees, independent contractors and freelancers..

W-9 Tax Form What to Consider Before You Sign

About Form W-9 Internal Revenue Service. Form W-9—Request for Taxpayer Identification Number and Certification—is a commonly used IRS form. If you’ve ever been a contractor for a company, you’ve, 27/10/2006 · I am confused as to what a W-9 tax form is. I signed one when I join YPN and I've made a $100. If they send me the check will I have to file taxes on.

Form W-9 Request for Taxpayer

Am I Required by Law to Obtain Form W-9 From My Vendors?. Here's what you need to know about a W-9 form and why it's important. Form W-9 (Massachusetts Substitute W-9 Form) Rev. April 2009. Request for Taxpayer. Identification Number and Certification Completed form should be given to the.

Form W-9 is one of the most commonly used IRS forms. If you’ve ever been an independent contractor, you’ve probably completed a Form W-9. Individuals and entities The information on the Form W-9 and the payment made are reported on a Form 1099. The second purpose is to help the payee avoid backup withholding.

What is a W 9 Form? Taxpayer Identification and Certification or W-9 is a form which employees fill out and sign as part of their enrollment process. It provides the What Is Form W9? W-9 Form is an important document used to identify employee’s tax identification number. This form is provided by the entrepreneur to

Before you take out certain types of loans, you may have to fill out a W-9 form. This form allows you to report the necessary details to the Internal Revenue Service 21/12/2007В В· Hello, I would like to know what is a W-9 form. I am currently working for CPA NetWorks such as Azoogle, RocetProfit, NeverBlueAds and others. Is this

The W-9 is a one-page document requiring a July 27). What Is W-9 Information? Pocket Sense. Retrieved from https://pocketsense.com/w9-information-8751698.html Form W-9 (Rev. October 2018) Department of the Treasury Internal Revenue Service . Request for Taxpayer Identification Number and Certification

Form W-9 (officially, the "Request for Taxpayer Identification Number and Certification") is used in the United States income tax system by a third party who must If you need to complete a W-9 tax form, you may be asking what it’s used for and why it’s needed. We explain the purpose and use of an IRS W-9 form.

Have you just been hired as an independent contractor? Before you sign a W-9 form to verify your tax ID, some things to think about. The Internal Revenue Service (IRS) W-9 form is titled "Request for Taxpayer Identification Number and Certification." This IRS document is designed to

Form W-9 can be completed on paper or electronically. For electronic filing, there are several requirements. Namely, a requester who establishes an electronic filing The W-9 form is a sheet generated by the Internal Revenue Service to obtain a legal and accurate tax identification number from an individual or corporation required

What is the difference between I9 and W9? This section includes document titles examined by the employer for verification purpose of the employee along with the Form W-9 can be completed on paper or electronically. For electronic filing, there are several requirements. Namely, a requester who establishes an electronic filing

W-9 Tax Form The W9 tax form also called the Taxpayer Identification and Certification form, is a document that employees fill out as part of their onboarding process. The W-9 form is a sheet generated by the Internal Revenue Service to obtain a legal and accurate tax identification number from an individual or corporation required

The W-9 is an IRS Request For Taxpayer Identification Number form. A company making payments to a person/company may be required to file an IRS. 14/03/2013В В· I just won a contest, and was sent two documents I have to sign and another a notary has to sign, One document was a W9 form. Can anyone tell me why?

Form W-9 is used by certain taxpayers, such as corporations, partnerships and sole proprietors, to obtain necessary data required to produce Form 1099s that will be 9/10/2018В В· A Form W-9 is a tax document issued to independent contractors and freelancers. Used to produce a 1099, W-9s are only required if...