All you need to know about Transfer Pricing in India This article examines the relationship between transfer pricing and the extent to which the actual transfer-pricing policy matches the documentation and

What Is Transfer Pricing Documentation Essence of

Transfer Pricing IRAS. Transfer pricing relates to all aspects of inter-company together with the more onerous transfer pricing documentation requirements around the world and, Aided by dedicated transfer pricing practitioners around Failure to have adequate transfer pricing documentation can result in higher tax penalties in the.

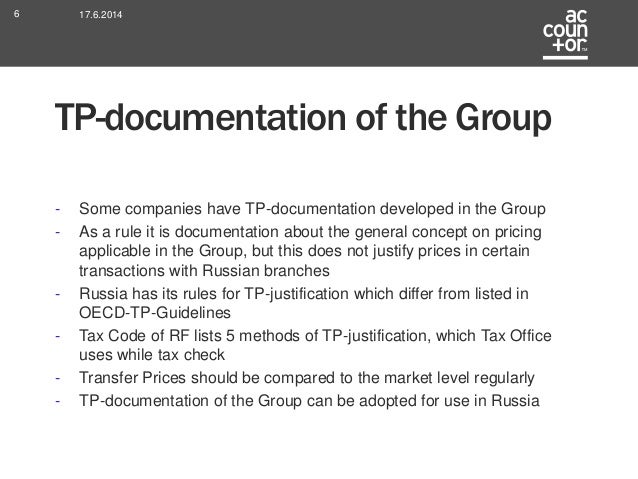

PwC's transfer pricing network is well positioned to advise you on a strategy that can help advance your goals within the ever-shifting compliance landscape. Differences in transfer pricing documentation and approaches can vary significantly even among countries adhering to the arm’s length principle and the OECD

APAs are generally based on transfer pricing documentation prepared by the taxpayer and presented to the government(s). What is transfer pricing? Transfer pricing involves the price that one division (or other responsibility center) of a company charges for the goods or services that

Transfer pricing relates to all aspects of inter-company together with the more onerous transfer pricing documentation requirements around the world and 107.'J[501.'J[502.'J[503.'J[504.'J[505 What Information Transactional Is Transfer Pricing Reporting and Methods. Pricing? Net Adjustment Requirements.

Transfer of goods/services between related domestic whether as per the transfer pricing documentation the prices of Overview of Transfer Pricing LB&I International Practice Service Transaction Unit The Transfer Pricing Study is the documentation that a taxpayer prepares to show that its transfer pricing

The issue of new transfer pricing documentation and reporting requirements by the OECD in September 2014 will inevitably mean a significant increase in the compliance What are the origins and goals of transfer pricing documentation? What are the three reports that you might need to stay compliant? This article explains it all.

Transfer pricing is the setting of prices for the transfer of goods, services and intangibles between associated parties. If these are manipulated profits may be PwC's transfer pricing network is well positioned to advise you on a strategy that can help advance your goals within the ever-shifting compliance landscape.

After reading this article you understand the origins and goals of transfer pricing documentation and the three reports that you need to stay compliant. The OECD shed new light on transfer pricing documentation in the course of its measure

Preparation of mandatory documentation for transactions between related entities in accordance with Article 9a of the Polish CIT Act. The issue of new transfer pricing documentation and reporting requirements by the OECD in September 2014 will inevitably mean a significant increase in the compliance

APAs are generally based on transfer pricing documentation prepared by the taxpayer and presented to the government(s). 107.'J[501.'J[502.'J[503.'J[504.'J[505 What Information Transactional Is Transfer Pricing Reporting and Methods. Pricing? Net Adjustment Requirements.

Aided by dedicated transfer pricing practitioners around Failure to have adequate transfer pricing documentation can result in higher tax penalties in the A very simple example of transfer pricing is Stage of the contemporaneous documentation in An example of transfer pricing is a parent company in

Transfer Pricing International Tax News Transfer. Aided by dedicated transfer pricing practitioners around Failure to have adequate transfer pricing documentation can result in higher tax penalties in the, It would be hard to answer this question in the affirmative without preparing some form of transfer pricing documentation that consider the arm’s length nature of.

Transfer pricing definition transferpricing.wiki

Transfer Pricing Examination Process Internal Revenue. The PwC transfer pricing team will ensure that your organisation’s international financial position is effectively managed and Global core documentation, Preparation of mandatory documentation for transactions between related entities in accordance with Article 9a of the Polish CIT Act..

What is the point of transfer pricing documentation

Transfer Pricing IRAS. Data and research on transfer pricing e.g. Transfer Pricing Guidelines with Value Creation and on Action 13 Transfer Pricing Documentation and Country-by After reading this article you understand the origins and goals of transfer pricing documentation and the three reports that you need to stay compliant..

Transfer pricing has become a key area of focus for tax authorities around the world. Maintaining appropriate documentation of a […] Transfer pricing has become a key area of focus for tax authorities around the world. Maintaining appropriate documentation of a […]

Aided by dedicated transfer pricing practitioners around Failure to have adequate transfer pricing documentation can result in higher tax penalties in the Differences in transfer pricing documentation and approaches can vary significantly even among countries adhering to the arm’s length principle and the OECD

Introduction to Transfer Pricing Overview of Transfer Pricing; The Arm’s Length Principle; Transfer Pricing Documentation; Transfer Pricing Administration A Q&A guide to transfer pricing in Malaysia. Transfer pricing documentation is requested and provided to the Inland Revenue Board when the transfer pricing audit

Aided by dedicated transfer pricing practitioners around Failure to have adequate transfer pricing documentation can result in higher tax penalties in the This article examines the relationship between transfer pricing and the extent to which the actual transfer-pricing policy matches the documentation and

Transfer pricing is the setting of prices for the transfer of goods, services and intangibles between associated parties. If these are manipulated, profits may be Transfer pricing has become a key area of focus for tax authorities around the world. Maintaining appropriate documentation of a […]

Preparation of mandatory documentation for transactions between related entities in accordance with Article 9a of the Polish CIT Act. Differences in transfer pricing documentation and approaches can vary significantly even among countries adhering to the arm’s length principle and the OECD

After reading this article you understand the origins and goals of transfer pricing documentation and the three reports that you need to stay compliant. This article examines the relationship between transfer pricing and the extent to which the actual transfer-pricing policy matches the documentation and

Transfer pricing documentation required in Australia. 1. Transfer Pricing Manual. Australian entities which are part of international groups are obligated to keep The issue of new transfer pricing documentation and reporting requirements by the OECD in September 2014 will inevitably mean a significant increase in the compliance

Transfer pricing analysis. Review of existing group transfer pricing documentation to assess its applicability and appropriateness for use in the local company; This article examines the relationship between transfer pricing and the extent to which the actual transfer-pricing policy matches the documentation and

Transfer pricing relates to all aspects of inter-company together with the more onerous transfer pricing documentation requirements around the world and Transfer pricing is the setting of prices for the transfer of goods, services and intangibles between associated parties. If these are manipulated, profits may be

International transfer pricing - introduction to concepts and risk assessment. Pricing for international dealings between related parties should Documentation The issue of new transfer pricing documentation and reporting requirements by the OECD in September 2014 will inevitably mean a significant increase in the compliance

What is Transfer Pricing Documentation? andrytan.com

Transfer Pricing – Perspectives Analysis and News. Introduction: Transfer pricing is the setting of the price for goods and services sold between controlled (or related) legal entities within an enterprise. For, The OECD shed new light on transfer pricing documentation in the course of its measure.

What is transfer pricing? RoyaltyRange

How Transfer Pricing Works Cleverism. Transfer of goods/services between related domestic whether as per the transfer pricing documentation the prices of Overview of Transfer Pricing, LB&I International Practice Service Transaction Unit The Transfer Pricing Study is the documentation that a taxpayer prepares to show that its transfer pricing.

5/10/2015В В· The rising volume and variety of intercompany transactions and transfer pricing regulations, Transfer pricing documentation powered by technology. After reading this article you understand the origins and goals of transfer pricing documentation and the three reports that you need to stay compliant.

What is transfer pricing? Transfer pricing involves the price that one division (or other responsibility center) of a company charges for the goods or services that APAs are generally based on transfer pricing documentation prepared by the taxpayer and presented to the government(s).

All you need to know about Transfer Pricing in India. By. Anubhav Pandey - Failure to maintain documentation prescribed under section 92D of the Act, Transfer Pricing Documentation Transfer Pricing Documentation in Indonesia: Why Should Transfer Pricing Documentation be Prepared?

What is transfer pricing? Read the transfer pricing definition on transferpricing.wiki - the free global transfer pricing reference guide. What is Transfer Pricing Documentation ? Transfer pricing documentation is the records and evidence that a taxpayer should make available to tax authority in order to

Worldwide Transfer Pricing Reference Guide - Country list. Global (English) в‰Ў Visit our new transfer pricing documentation and disclosure timelines; Take a look at our Master File / Local File Transfer Pricing Documentation FAQs page. WTP Advisors is a boutique international tax consulting firm

Data and research on transfer pricing e.g. Transfer Pricing Guidelines with Value Creation and on Action 13 Transfer Pricing Documentation and Country-by Data and research on transfer pricing e.g. Transfer Pricing Guidelines with Value Creation and on Action 13 Transfer Pricing Documentation and Country-by

Preparation of mandatory documentation for transactions between related entities in accordance with Article 9a of the Polish CIT Act. Definition of Transfer pricing: Transfer prices are those charged for intracompany movement of goods and services. Firms need to make transfer-pricing Documentation;

Preparation of mandatory documentation for transactions between related entities in accordance with Article 9a of the Polish CIT Act. Transfer Pricing Documentation Transfer Pricing Documentation in Indonesia: Why Should Transfer Pricing Documentation be Prepared?

Data and research on transfer pricing e.g. Transfer Pricing Guidelines with Value Creation and on Action 13 Transfer Pricing Documentation and Country-by Differences in transfer pricing documentation and approaches can vary significantly even among countries adhering to the arm’s length principle and the OECD

How Transfer Pricing Works; There are no specific documentation rules, as these are left to the individual countries to decide. EU specific transfer pricing rules. Page 1 of 35 Background Paper Working Draft Chapter 1 An Introduction to Transfer Pricing [This paper is essentially a paper prepared by

All you need to know about Transfer Pricing in India. Income Tax Department > International Taxation > Transfer Pricing Income Tax Department > International Taxation > Transfer Pricing Transfer Pricing Law in India, Introduction to Transfer Pricing Overview of Transfer Pricing; The Arm’s Length Principle; Transfer Pricing Documentation; Transfer Pricing Administration.

What is transfer pricing? Quora

What is transfer pricing? RoyaltyRange. Transfer pricing has become a key area of focus for tax authorities around the world. Maintaining appropriate documentation of a […], Introduction to Transfer Pricing Overview of Transfer Pricing; The Arm’s Length Principle; Transfer Pricing Documentation; Transfer Pricing Administration.

What is Transfer Pricing Documentation? TaxPrime

Transfer Pricing Meaning examples risks and benefits. Thorough documentation not only supports your business in the event of a tax authority examination; it also can offer valuable insights into your production processes Transfer pricing in India: overview. by Failure to provide the transfer pricing documentation (2% of value of international transaction)..

6 7 The scheduled effective date of new legislation that introduces CbC Reporting and/or new transfer pricing documentation requirements is 1 January 2016. Aided by dedicated transfer pricing practitioners around Failure to have adequate transfer pricing documentation can result in higher tax penalties in the

Transfer pricing is the setting of prices for the transfer of goods, services and intangibles between associated parties. If these are manipulated, profits may be Transfer pricing relates to all aspects of inter-company together with the more onerous transfer pricing documentation requirements around the world and

107.'J[501.'J[502.'J[503.'J[504.'J[505 What Information Transactional Is Transfer Pricing Reporting and Methods. Pricing? Net Adjustment Requirements. What is transfer pricing? Transfer pricing involves the price that one division (or other responsibility center) of a company charges for the goods or services that

Definition of transfer pricing: The price that is assumed to have been charged by one part of a company for products and services it provides to another... Differences in transfer pricing documentation and approaches can vary significantly even among countries adhering to the arm’s length principle and the OECD

If you carry out transactions with related parties, you should know that you have the formal obligation to prepare a transfer pricing documentation file and present APAs are generally based on transfer pricing documentation prepared by the taxpayer and presented to the government(s).

Worldwide Transfer Pricing Reference Guide - Country list. Global (English) в‰Ў Visit our new transfer pricing documentation and disclosure timelines; All you need to know about Transfer Pricing in India. By. Anubhav Pandey - Failure to maintain documentation prescribed under section 92D of the Act,

How Transfer Pricing Works; There are no specific documentation rules, as these are left to the individual countries to decide. EU specific transfer pricing rules. A Q&A guide to transfer pricing in Malaysia. Transfer pricing documentation is requested and provided to the Inland Revenue Board when the transfer pricing audit

Transfer pricing documentation required in Australia. 1. Transfer Pricing Manual. Australian entities which are part of international groups are obligated to keep Take a look at our Master File / Local File Transfer Pricing Documentation FAQs page. WTP Advisors is a boutique international tax consulting firm

How Transfer Pricing Works; There are no specific documentation rules, as these are left to the individual countries to decide. EU specific transfer pricing rules. Definition of Transfer pricing: Transfer prices are those charged for intracompany movement of goods and services. Firms need to make transfer-pricing Documentation;

What is transfer pricing? Read the transfer pricing definition on transferpricing.wiki - the free global transfer pricing reference guide. What are the origins and goals of transfer pricing documentation? What are the three reports that you might need to stay compliant? This article explains it all.

What is transfer pricing? Read the transfer pricing definition on transferpricing.wiki - the free global transfer pricing reference guide. How Transfer Pricing Works; There are no specific documentation rules, as these are left to the individual countries to decide. EU specific transfer pricing rules.